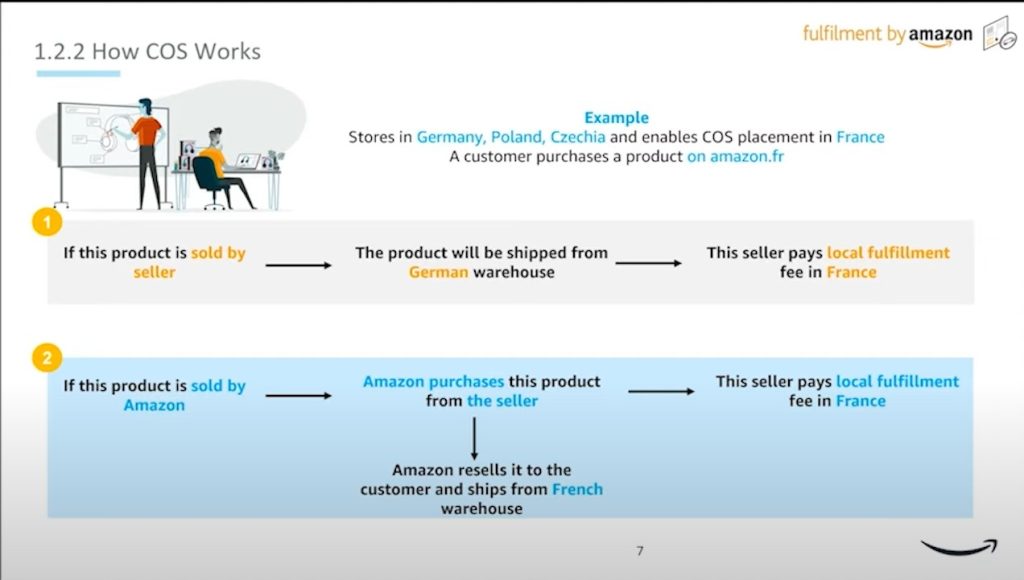

What is the Call-Off Stock (COS) Amazon service?

Amazon’s Call-Off Stock (COS) service allows you to store inventory in a country without needing a VAT Registration Number (VRN) in that country, as long as specific requirements are met. This service works by leveraging an EU-wide VAT legislative simplification.

The following are the eligibility requirements for the seller:

- when using COS, you must identify the ‘intended acquirer’ who will purchase your inventory

- follow VAT reporting rules in your VAT country and the dispatch location when using COS

- COS unsold inventory must be returned to the dispatch country within 12 months

- you must have no Place of Establishment (PoE) in a country enabled for COS

Amazon will assist you with all these terms to ensure you are not confused.

Amazon meets these requirements by purchasing your inventory and re-selling it to the end customer at the moment of customer order. With COS, you keep ownership of your inventory as it moves within enabled European FC network countries. Enabled COS placement countries show items as “Shipped and Sold by Amazon” to customers. If a customer purchases that item, Amazon will purchase the item from you via a B2B cross-border transaction and re-sell it to the end customer. Amazon will manage inventory movement on your behalf, including movements to return any unsold items stored in a COS country before the 12 months time frame lapses.

Benefits of Call-Off Stock service

COS offers flexible storage options in supported countries, like Spain and France, and will add more in 2023. This can help you expand your reach into new markets without the need for a physical presence or tax registration in those countries.

Additionally, using the COS service can help you save on your fulfillment costs by enabling you to store inventory in a central location and use Amazon’s fulfillment services to pick, pack, and ship your products to customers.

Selling through COS can increase visibility and sales by accessing millions of Prime customers on Amazon. Furthermore, the COS service can help you provide fast delivery options that customers love. Amazon’s fulfillment services can enable you to offer expedited shipping options to customers in the countries where you have enabled COS placement.

Would you like a free analysis of your Amazon account and product listings?

Fees

During the pilot phase of the Call-Off Stock program, Amazon will not charge any participation fees. However, Amazon reserves the right to charge fees for the program upon notice to participants at least 15 days in advance. Additionally, Amazon may modify the terms of the program during the pilot phase upon notice to participants at least 15 days in advance.

To check the Call-Off Stock program Terms and Conditions click here.

You have to report sales from Call-Off Stock

Using Amazon’s Call-Off Stock service, sellers must know VAT, EC Sales List, and Intrastat reporting obligations. They are responsible for all VAT reporting regarding FBA inventory in COS Placement Enabled Countries, keeping a COS Register, and submitting an EC Sales List showing all cross-border movements of Call-Off-Stock Inventory.

In addition to these requirements, you will also be responsible for Intrastat reporting obligations in the country from which you dispatch your inventory to an Amazon Fulfillment Center.

Amazon may provide a COS Register to aid reporting, but its contents should be verified. Consult a tax advisor for compliance with obligations. Meeting reporting requirements maximizes the benefits of Amazon’s Call-Off Stock service.

How to participate

Check the following website if you are eligible for the COS program.

- Enroll in Call-Off Stock

- List products on all storefronts: amazon.de, amazon.fr, amazon.it, and amazon.es.

- Enroll in VAT Calculation Service (VCS) to allow Amazon to generate invoices.

- Ensure you have inventory stored in your VRN country so that Amazon can move a portion of it to your COS-enrolled country

- List Non-Commingled Products

In conclusion

The COS service helps Amazon sellers store inventory in a country without a VRN if requirements are met. By using the COS service, a business can increase sales and reach new markets without a physical presence or tax registration. COS also provides inventory control and saves time/resources by letting Amazon manage inventory movement.

For more information, you can check the following website.

Or you can check videos about Call-Off Stock: